The FACS of life

May 3, 2017

With tax day having come and gone, and seniors soon departing, I got to thinking: students can leave high school knowing how to balance quadratic equations, but not being able to simply balance a checkbook. They will have whipped up hundreds of essays, but may not understand insurance premiums. Students have studied the Founding Fathers’ positions on taxation, but have no idea how to pay them themselves.

School teaches students five basic subjects, with some exceptions: English, math, science, social studies, and a foreign language. But the one subject that is not taught, but is critical to survival in our society, is Financial Literacy. Financial Literacy is a course with many facets; some may not be covered by every class, but there definitely should be a class that at least covers a few major topics. Money management, credit reports, insurance reports, and how to pay bills should be taught in school.

Christine McConnell, a Family and Consumer Sciences teacher at Arvada West discussed Arvada West’s ability to prepare students. In McConnell’s opinion, the most important skill to learn is, “…making a budget, and understanding how, what a budget helps you gain in your future.” She goes on to say that not taking a FACS (Family and Consumer Sciences) class can negatively impact you. She claims that “Kids that do not have the opportunity to learn before they make the mistake, they make the mistake and then learn.” This sink or swim mentality should not be tolerated at a school.

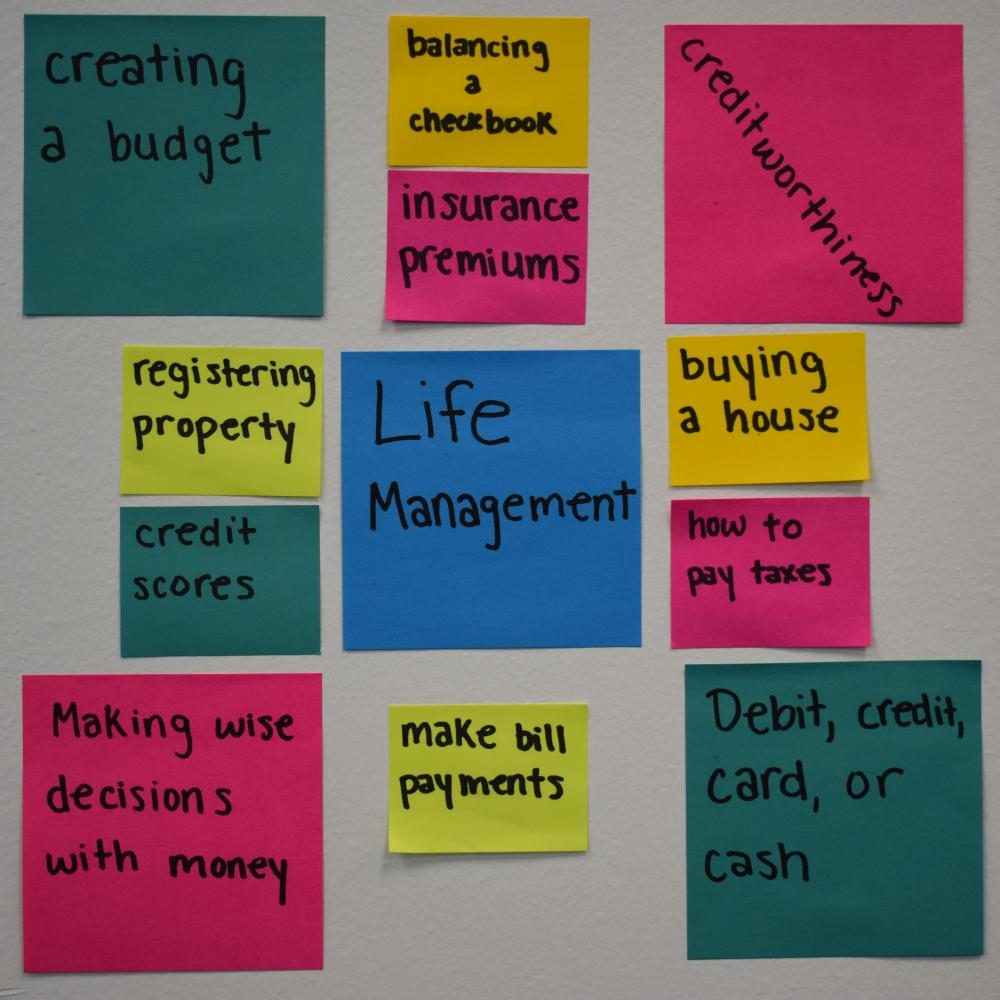

At this moment, only few classes at Arvada West are taught containing these simple, yet crucial, tasks. One class, Life Management, goes over many of the basic financial principles. It covers a host of skills including basic skills such as making a budget, to more complex things like big ticket purchases. This course is offered to all Juniors and Seniors. Unfortunately, it is not mandatory; though according to McConnell, “Colorado State Law requires that students, K-12, (meet) financial literacy standards.” At Arvada West, Econ is the only required course that meets these criterium, but it does not go as in depth in the personal level. Life Management, is crafted to comply with all those standards.

All types of student join the class, from 4.0 students to those entering the workforce immediately after high school. Even though this class is, arguably, incredibly important, only around 120 kids take it a year. Out of around 807 junior and senior students, that is less than fifteen percent of able students. The problem may be a lack of awareness that the class even exists, or just that no one wants to take it, but financial literacy needs to be taught to every student in order to prepare them for the future.

According to the study, Money Matters on Campus, of the 40,000 college students surveyed, 40 per cent stated that they did not feel prepared to be in charge of their own finances; 25 percent said they spend the same amount of money, no matter the balance of their bank account. Extraordinarily, 12 percent admitted to never even checking their bank accounts for fear of what they might see. These are not promising statistics, but considering the circumstances, it is impressive that more than half felt prepared to run their own accounts and run their lives with financial competency. They believed that with the state of their knowledge, they were capable of spending money with confidence. With the current state of financial education, these numbers should come as no surprise, but there is a solution.

Starting next year, Lifetime Fitness Education will be mandatory for all Freshmen, with the intent on forming good health-related habits. While good health is valued very high, financial literacy is just as important and if not, more so, because good eating does nothing if one can’t responsibly budget to buy it. Arvada West should make a Financial Literacy course part of the required fields to graduate in order to meet the school’s requirement that it is supposed to prepare students for life outside of school, and a good step towards that goal is to require students to take it.

A few of the many skills taught in Life Management

- Balancing a checkbook

- Explaining taxes and how to pay them

- Make wise decisions with money

- Make bill payments

- Decide whether to have a debit or credit card and how to responsibly use it

- Insurance explanations and premiums

- Registering things (cars, residence, income) with authorities

- When and if to buy a house]

- Creating a budget

- Interpret a credit score and know how it is used to determine creditworthiness